So you want to support Israel, and be part of her economic success. But you don’t live in Israel, and don't travel there often. So how to do it? This article will help.

In other articles, we discussed why we invest in Israel. We described reasons such as currency and global diversification, and the desire to support the Land and people of Israel. Other reasons include participating in the prosperity Israel is experiencing since its rebirth, and enjoying the fruit of a strong and robust economy.

The “How”

So how can this be accomplished practically? By investing in Israel's capital market via Israeli stocks and bonds. This is done by opening an investment account with one of the established Israeli brokerage firms, or investing through your current investment account in your country. Accounts may be opened online or through the mail - no need to travel to Israel to open the account. Citizens of all countries may invest in an Israeli brokerage account.

Israeli investment accounts are regulated and supervised by the Israel Securities Authority, and non-Israeli investment accounts are regulated by your countries securities regulator. An investment account can be funded with all currencies (U.S. dollars, U.K. pounds, Canadian dollars, Euros, Israeli shekels, etc.) via a direct deposit or wire transfer to the brokerage where your account is held.

What can I invest in?

Accredited investors and non-accredited non-investors alike can invest in a wide array of investments, ranging from Israeli stocks offering dividend payments, to secure Israeli government bonds, through inflation-protected corporate bonds paying fixed quarterly interest payments, to Exchange Traded Funds tracking to market Israeli indices. The choice of how secure the portfolio is to be (or how risky) is entirely up to the account holder in consultation with our licensed Portfolio Management personnel.

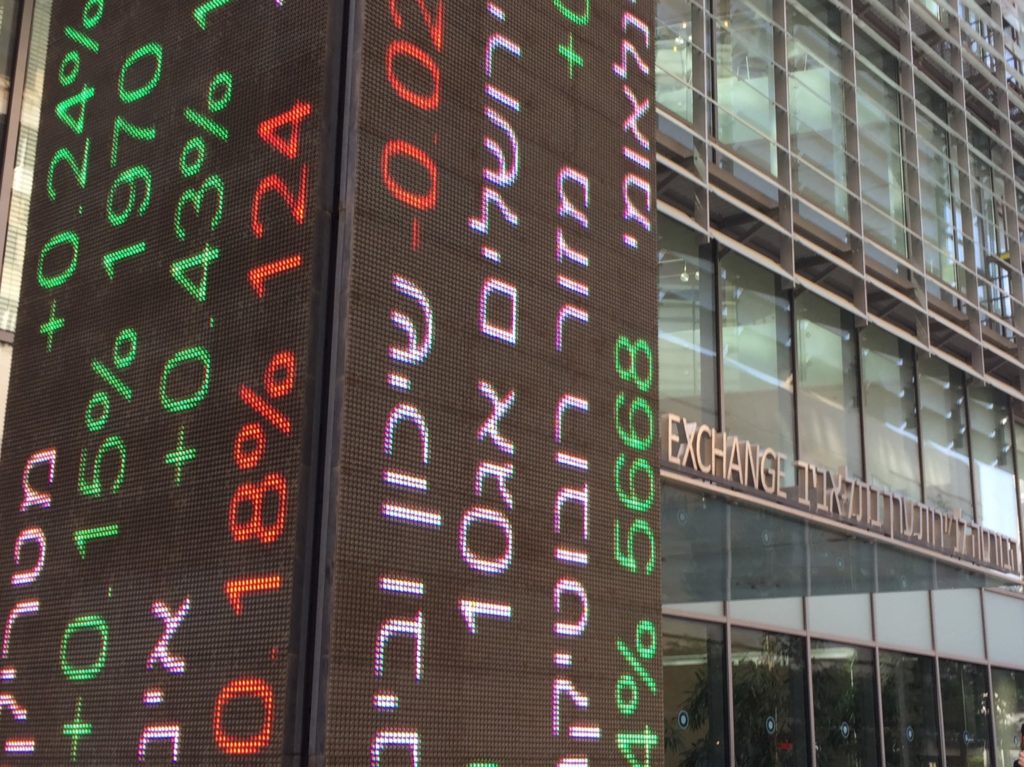

Israel's national exchange offers all the major business sectors offered in other markets around the world, including: technology, real estate, industry and manufacturing, communication, biomedical, agrotech, insurance, finance and banking, commerce and services, chemical/rubber/plastics, food, transportation, etc. Of particular interest is the new oil/gas exploration sector, given Israel’s recent large-scale discoveries of these commodities. Companies in these and other sectors are listed on the Tel Aviv Stock Exchange. Additionally, many Israeli technology companies are listed on Nasdaq, and can be accessed through one of the large U.S. or international brokerage firms.

Types and size of accounts

Investment account may be opened as an individual account, joint account, partnership, organization, corporation, U.S. or Israeli trust or a through a U.S. retirement account rollover (Traditional or Roth IRA, 401(k), 403(b), 457, etc.). Once funded, foreign currency is converted to Israeli currency as needed, and then securities are purchased directly into the account (stocks, government or corporate bonds and ETFs).

Israeli securities are listed for the account holder on the Tel Aviv Stock Exchange (TASE), or are listed on Nasdaq by the broker-dealer in the U.S.

Do I need to know Hebrew to invest?

No. All brokerages our firm works with (including Israeli brokerages, U.S. and international brokerages) provide an English web interface for clients to monitor their investments and view their performance daily, monthly, quarterly or annually. English account statements are issued quarterly to clients.

How much does it cost to hold an Israeli investment account?

Brokerage commissions are between 0% to 0.16% of the value of a given transaction.

Additionally, one Israeli brokerage charges a 0.19% custodial fee per year (based on funds in the account), and a flat $5/month fee. For a $100,000 account, this amounts to about $255/year.

Professional portfolio management services are offered by our firm on a sliding scale based on a percentage the amount of money held in the account annually.

Must I hold my investment for a certain period of time?

When investing in Israeli stocks, bonds, ETFs and mutual funds, transactions are made electronically (online) and immediate, with no penalties, extra commissions or sales loads upon withdrawal. Investors may buy and sell stocks, bonds, ETFs or mutual funds for a day or for ten years, with no difference in fees.

How are funds withdrawn?

Many brokerages allow online electronic direct withdrawal to your bank. Others require an online request form to execute an immediate wire transfer back to your listed bank account of any amount in the account in the currency of your choice.

What options are available for capital preservation?

Those interested in preserving their wealth in shekels more than they are interested in growth will tend to invest more in Israeli government bonds. Those bonds are backed by the Government of Israel (which has never defaulted on an a single interest or principal payment). Others that desire capital preservation, but are interested in higher yield than government bonds, choose instead Israeli corporate bonds. These bonds pay quarterly, bi-annual or annual interest payments in shekels into your account, and the payment amount may be unlinked, linked to inflation, linked to the USD, or vary according to interest rates.

Taxation

There is no tax levied on moving funds abroad or back to your home country. There is no tax on simply holding Israeli securities. For the investor residing outside of Israel, virtually all stock and bond gains are not taxed in Israel (see our article on

taxation here), and the investor pays taxes in their own country according to their country's taxation laws. Israeli gains are taxed like other domestic gains in the investor's country of residence.

Conclusion

Investing in Israel is possible and straightforward. Investors are able to diversify their holdings globally and participate in Israel’s economic success. Investor's funds are denominated in shekels. Investment accounts are secure and manageable in English. One can invest to either preserve capital or to receive good, solid returns. All this, while supporting Israel and its people.

Accredited investors and non-accredited non-investors alike can invest in a wide array of investments, ranging from Israeli stocks offering dividend payments, to secure Israeli government bonds, through inflation-protected corporate bonds paying fixed quarterly interest payments, to Exchange Traded Funds tracking to market Israeli indices. The choice of how secure the portfolio is to be (or how risky) is entirely up to the account holder in consultation with our licensed Portfolio Management personnel.

Accredited investors and non-accredited non-investors alike can invest in a wide array of investments, ranging from Israeli stocks offering dividend payments, to secure Israeli government bonds, through inflation-protected corporate bonds paying fixed quarterly interest payments, to Exchange Traded Funds tracking to market Israeli indices. The choice of how secure the portfolio is to be (or how risky) is entirely up to the account holder in consultation with our licensed Portfolio Management personnel. Israel's national exchange offers all the major business sectors offered in other markets around the world, including: technology, real estate, industry and manufacturing, communication, biomedical, agrotech, insurance, finance and banking, commerce and services, chemical/rubber/plastics, food, transportation, etc. Of particular interest is the new oil/gas exploration sector, given Israel’s recent large-scale discoveries of these commodities. Companies in these and other sectors are listed on the Tel Aviv Stock Exchange. Additionally, many Israeli technology companies are listed on Nasdaq, and can be accessed through one of the large U.S. or international brokerage firms.

Israel's national exchange offers all the major business sectors offered in other markets around the world, including: technology, real estate, industry and manufacturing, communication, biomedical, agrotech, insurance, finance and banking, commerce and services, chemical/rubber/plastics, food, transportation, etc. Of particular interest is the new oil/gas exploration sector, given Israel’s recent large-scale discoveries of these commodities. Companies in these and other sectors are listed on the Tel Aviv Stock Exchange. Additionally, many Israeli technology companies are listed on Nasdaq, and can be accessed through one of the large U.S. or international brokerage firms.

Comments 5

Would like more info on investing in Israel.

Look forward to receiving your info

Would like more info on investing in Israel

I noticed it says on here that you must have 5000usd to open a self managed account. Can you open an account for less if it is not self managed?

hey, I’m very interested to invest in Israel.

We are Christians and want to do something.

We have no more than 2,000 euros to invest, but I believe that something can be done and if God says through the script that we must invest properly then it can only be in Israel, His country with His people. Can you help us ?! regards Jessie